Looks like there is a glimmer of hope in the construction/equipment sector.

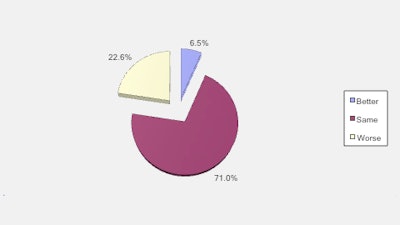

Although we already know the equipment rental market has been going gangbusters, the Equipment Leasing & Finance Foundation (the Foundation) July 2012 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) released today shows that financing equipment is looking up. (For pie charts from the survey findings, click here.)

The index found that confidence in the equipment finance market is 51.5, up from the June index of 48.5. According to the Foundation, this however reflects continuing concern about external economic factors and regulatory and political uncertainty.

The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $628 billion equipment finance sector.

When asked about the outlook for the future, MCI survey respondent Russell D. Nelson, president, Farm Credit Leasing Services Corporation, said, “Continued volatility/uncertainty at home and abroad may inhibit planned/needed capital expenditures during the next six months, but low interest rates and tax incentives will enable our industry to generate modest increases in asset volume and profitability through the remainder of 2012.”

He added, “Improving credit quality, stable earnings, and demand for innovative/creative lease and loan products should position our industry for improved growth in 2013 and beyond.”