Looking at the year ahead, contractors are optimistic about construction demand in almost every public-sector segment and certain private-sector segments – even more so than in 2024. But that optimism is tempered by ongoing concerns about labor shortages and material prices.

That’s according to the 2025 Construction Hiring and Business Outlook Survey by the Associated General Contractors of America and Sage, which surveyed more than 1,100 AGC member firms nationwide between November 6 and December 13.

“2025 offers quite a few bright spots for the construction industry even as the outlook for some private-sector segments remains quite dire,” said AGC CEO Jeffrey Shoaf. “Firms expect regulatory relief will help drive demand, and they will continue to hire when they can and boost investments in technologies, particularly artificial intelligence.”

Project Demand Increases

Survey results indicate that the 2021 Infrastructure Investment and Jobs Act is finally starting to make a difference in the construction project landscape. At the same time, concerns about high interest rates or an economic slowdown are beginning to fade.

“One reason contractors have a relatively positive outlook for many public-sector market segments is that more contractors are starting to see the effects of increased federal investments in infrastructure,” said Ken Simonson, the association’s chief economist.

Eighteen percent of respondents said they have worked on new federally funded infrastructure projects, double the 9 percent who said that was the case a year ago. In addition, 5 percent have won bids but have not started work, and 7 percent say they have bid on projects but have not won any awards yet.

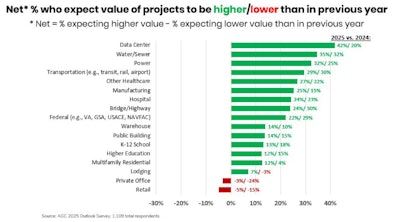

Contractors were asked about their expectations for the dollar value of projects they compete for in 2025 in specific industry sectors when compared to 2024.

The net reading was positive for 15 of the 17 categories of construction included in the survey, with data centers, water and sewer, and power projects topping the list. Private office and retail were the only two segments to see declines. The complete list is provided in the AGC chart below:

AGC

AGC

“I don’t know if it’s the election just being over or who won, but you know, as soon as that happened with that one point of drop in the Fed, our phone’s been ringing off the hook again,” said Rex Kirby, CEO of West Palm Beach, Florida-based Verdex Construction. He noted that his biggest concern going forward is the availability and capacity of subcontractors once projects start taking off in the second quarter of the year.

Andy Heitmann, vice president and operations manager for Turner Construction, felt equally optimistic, adding, “We are extremely, extremely busy here in Kansas City. That’s not only infrastructure work but data centers. We have a lot of data center work, not only in Kansas City, but quite frankly, the whole north central region of the country.”

Despite the positive outlook, many contractors continue to see project postponements and cancellations, with 42 percent of firms reporting that a project was postponed in 2024 but rescheduled. Thirty-four percent of respondents reported projects were postponed or canceled and not rescheduled.

Sixteen percent have already experienced postponement or cancellation of a project that had been scheduled for either the first half of 2025 or later. Rising project costs and reduced funding availability were the chief reasons for delays or cancellations.

Hiring obstacles persist

To accommodate higher project demand in 2025, more than two-thirds (69%) of the construction firms surveyed expect to add to their headcount. Only 10 percent expect a decrease, while the remainder plan no change. A little less than half (48%) plan to boost employment by up to 10 percent, with 17% planning to add up to 25% more headcount and 4% projecting an increase above 25%.

However, ongoing labor challenges continue to dampen contractor’s plans for growth. Contractors’ top three concerns for the year were all workforce-related, with 62% picking rising labor costs, 59% listing insufficient supply of workers and 56% noting the reduced quality of the labor available.

“We have a great labor force. It’s a very hardworking labor force, but it’s a very unskilled labor force,” Kirby said. “It takes a lot more supervision on our part to get the work done and make sure it’s done properly.”

Firms expressed ongoing difficulty in filling both hourly craft and salary positions, with little expectation for improvement in the next 12 months.

As such, 53% of employers increased base pay rates by more than they had in 2023, 28% provided incentives or bonuses and 28% increased their portion of benefit contributions and/or improved employee benefits to attract and retain workers. Respondents to Equipment World’s 2024 Heavy Equipment Operator Pay & Benefits Report cited similar increases in pay and benefits year over year.

Outside of workforce, the only other concern cited by a majority – 54 percent – of respondents is materials costs. Given the supply chain improvements, Simonson said this concern is likely related to President-elect Trump’s threats to impose a broad range of new tariffs.

The industry’s plea to Washington

With labor in short supply and a recent history of volatile material prices, AGC says many contractors worry how the incoming Trump administration’s immigration and trade policies may exacerbate those issues.

As such, the association is urging President-elect Trump and the incoming Congress to take the following steps to address the construction workforce shortage, improve access to federal projects, avoid material price inflation and streamline the permitting process:

- Establish new, temporary work visa programs that are dedicated to the construction industry.

- Pass the Stronger Workforce for America Act to boost funding for post-secondary construction training programs.

- Increase funding for the Carl D. Perkins Career and Technical Education Act that funds high-school construction training programs, among other career and technical education subjects.

- Revoke President Biden’s executive order imposing project labor agreements for any federal construction project worth $35 million or more.

- Remove the obstacles the Biden administration put in place with Buy America requirements.

- Find ways to exclude products needed to build domestic manufacturing, energy and infrastructure capacity when implementing new tariffs.

- Take measures to streamline the permitting process and accelerate Federal reviews.

Technology adoption remains steady

Perhaps in an effort to cope with hiring woes, more contractors are turning to tech to increase efficiency and make the best of their limited resources.

Artificial intelligence leads the way as the technology with the biggest anticipated increase in investment, cited by 44 percent of firms. Other key investment areas included document management software (40 percent), accounting software (36 percent), and project management software (35 percent).

“AI’s potential to revolutionize construction workflows is driving increased interest and investment,” said Dustin Stephens, global head of construction, Sage. “Leading construction businesses are utilizing advancements in AI, cloud, and mobile technologies to operate more efficiently and tackle complex projects with greater agility.”

Stephens added that while cloud adoption remains steady—61 percent of firms now use cloud-based project management tools—cybersecurity has emerged as the top IT challenge, cited by 41 percent of respondents. Finding the time to implement and train on new technology came in second with 38 percent of firms picking it as a top IT challenge.

“As firms embrace innovation, addressing security concerns and streamlining implementation will be critical to sustaining growth in a rapidly evolving industry,” he said.

To read the full 2025 Construction Hiring and Business Outlook Report, click here.