Editor's Note: The data in this article was corrected on June 19. A previous version listed Kubota compact track loaders by option instead of model.

Compact track loaders – or track skid steers – represented the largest category of new and used financed equipment sold within the last year.

A total of 48,210 new compact track loaders were financed from April 1, 2023, to March 31, 2024, according to Fusable’s EDA equipment finance data, a 9.2% increase from the previous period. Used financed CTL sales rose 2.1% during the period to 16,813 units.

Kubota retained its position as the top seller of new financed units with 26% of total sales. Bobcat and Cat were neck and neck for the No. 2 and 3 positions, with Bobcat selling just nine more units, giving both manufacturers a 21% share of total sales. The best-selling models included the Kubota SVL75-3, Kubota SVL97-2 and Cat 259D3.

[Watch: A Closer Look at Kubota’s All-New SVL75-3 Compact Track Loader]

Cat rolled out its next generation of compact track loaders last fall. The new Cat 255 replaced the 259D3, while the 265 replaced both the 279D3 and 289D3. Deere also recently added three new large-frame compact track loaders to its P-Tier lineup: the 331, 333 and 335 P-Tier. We expect to see these new models replace legacy models on next year’s charts.

Bobcat claimed the top spot for the most financed used CTLs with 26% of all sales. Cat came second with 23%, and Deere took third with 17%. At the date we examined the data, the top-selling used models were the Kubota SVL75-2, Deere 333G and Kubota SVL95-2.

Texas had a commanding share of new financed CTL sales, accounting for 14% of total sales or 6,809 units. Buyers of new CTLs were also prevalent in Florida (3,225 units) and Georgia (2,362 units).

The top states for those financing used CTLs were Texas (1,834), Missouri 91,362) and Tennessee (827).

EDA data is compiled from state UCC-1 filings on financed construction equipment. EDA continually updates this data as information comes in from each state.

Used Compact Track Loader Prices

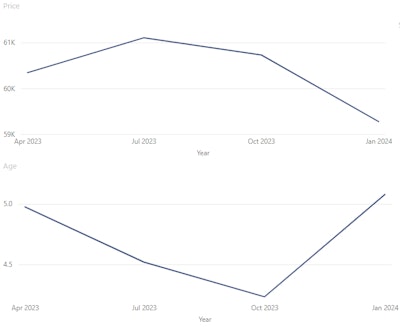

Used compact track loader prices have remained relatively flat during the 12-month period from April 1, 2023, to March 31, 2024, according to Fusable’s EquipmentWatch market trend data.

During that time, the average price for a used CTL peaked at $61,103 in the third quarter of 2023. Prices have been on a downward trend since, falling to $59,275 during the first quarter of 2024. The average age of used CTLs also remained steady, inching up from 5 years to 5.1 years. The average age and price were calculated on 329,258 resale listings during the period in the EquipmentWatch database.

Average price and age of used compact track loaders over the past 12 months, according to EquipmentWatch.EquipmentWatch

Average price and age of used compact track loaders over the past 12 months, according to EquipmentWatch.EquipmentWatch

EquipmentWatch defines fair market value (FMV) as the monetary value of an asset that can be expected in a transaction with a single seller and single buyer, neither of whom is under any compulsion or time restriction to complete the transaction. FMV for heavy equipment is most closely associated with the private, resale market, as opposed to the public, auction market.

Auction Markets

Looking at the top 20 compact track loaders sold for the 12-month period of May 1, 2023, to April 30, 2024, in terms of auction price, Cat took 12 of the top 20 price spots, with Bobcat, Case, Deere and Kubota claiming the other positions on the list.

Two 2023 Cat 299D3 XE CTLs took the top-two price spots. The loaders sold for $140,000 at a Blackmon Auctions sale in Little Rock, Arkansas, on February 1, 2024, as reported by the EquipmentWatch auction price guide.

Two 2022 Bobcat T870 CTLs nabbed the third and fourth price spots. The loaders sold for $125,000 at a J.M. Wood Auction Company sale in Montgomery, Alabama, on June 13 and 15, 2023.

EDA and EquipmentWatch are owned by Fusable, parent of Equipment World.