Most popular machine in terms of units sold in the Northeast Region: Kubota SVL75-2 compact track loader.

Most popular machine in terms of units sold in the Northeast Region: Kubota SVL75-2 compact track loader.Financed new equipment sales in the Northeast Region of the U.S. dropped by 9 percent during the first quarter of 2019, compared with the same period last year, according to an analysis of UCC-1 filings as reported by EDA. The number of new units financed went from 3,154 in 2018 to 2,896 in 2019 during the first quarter.

States showing the largest declines in the number of new machines financed were Rhode Island (down 40 percent) and New Hampshire, (down 24 percent) compared with the first quarter of 2018. Maine, however, saw a 12 percent increase in new financed machine counts and Pennsylvania remained flat. (For a state-by-state review, go to the State Breakdowns section.)

The U.S. Census Bureau defines the Northeast Region as Maine, New Hampshire, Vermont, Massachusetts, Connecticut, Rhode Island, New York, Pennsylvania and New Jersey.

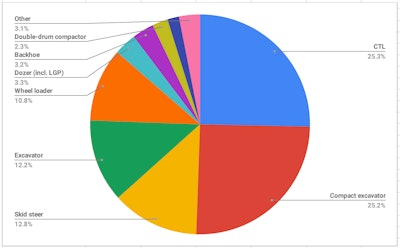

Northeast Region 1Q financed sales by type of construction equipment

Source: EDA.

Source: EDA.In part because of their lower initial cost, compact machines tend to dominate in terms of unit sales. Compact track loaders (CTLs) and compact excavators were the most popular machines sold in the region, almost tying for first and second place: 734 CTLs were sold in the region (25.3 percent of total machines), compared to 731 compact excavators (25.2 percent). Skid steer loaders, at 372, or 13 percent of total machines, came in a distant third. (We compiled this data on May 20th; EDA continually updates this data.)

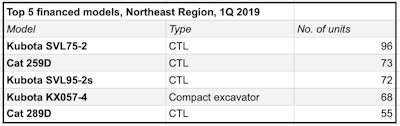

Source: EDA

Source: EDAIn terms of units sold, the Kubota SVL75-2 CTL, at 96 machines, topped the most popular model list. Looking at machine brand, nearly 24 percent of the number of new machines financed in the region were Cat, while Bobcat and Kubota tied for second place at 16.8 percent each.

Machines in this report include backhoes, dozers, articulated haulers, excavators (mid- and full-size), compact excavators, skid steers, compact track loaders, wheel loaders and toolcarriers, asphalt and concrete pavers, scrapers, graders and single and double-drum compactors.

State breakdowns

Here’s a state-by-state breakdown of the construction equipment financed during the 1Q. (Percentages are rounded.)

Connecticut

Total number of machines financed in the first quarter: 167 (down 13 percent from 1Q 2018)

Top models: Cat 259D CTL (6 machines); Komatsu WA270-8 wheel loader (6 machines); Bobcat S570 skid steer (5 machines).

Top three machine types: CTL (46 machines); compact excavator (45 machines); wheel loader (26 machines)

Top financed brands: Kubota (31 machines, 19 percent of total); Bobcat (29 /17 percent); Cat (22/13 percent); Deere (17/10 percent)

Massachusetts

Total number of machines financed in the first quarter: 367 (down 19 percent from 1Q 2018)

Top models: Cat 259D CTL (22 machines); Kubota SVL75-2 CTL (10 machines); Cat 725C-2 articulated truck (8 machines).

Top three machine types: Compact excavator (100 machines); CTL (94 machines); skid steer (52 machines)

Top financed brands: Cat (115 machines, 31 percent of total); Bobcat (72/20 percent); Kubota (50/14 percent); Deere (35/10 percent)

Maine

Total number of machines financed in the first quarter: 142 (Up 12 percent from 1Q 2018)

Top models: Kubota KX040-4 compact excavator (9 machines); Bobcat S550 skid steer (8 machines); Kubota SVL75-2 CTL (6 machines)

Top three machine types: CTL (39 machines); compact excavator (29 machines); skid steer (27 machines)

Top financed brands: Bobcat (34 machines, 24 percent of total); Cat (33/23 percent); Kubota (24/17 percent); Deere (21/15 percent)

New Hampshire

Total number of machines financed in the first quarter: 144 (Down 24 percent from 1Q 2018)

Top models: Deere 310SL backhoe (15 machines); Cat 305E2 CR compact excavator; Cat 305.5E2 CR compact excavator

Top three machine types: Compact excavator (37 machines); CTL (23 machines); wheel loader (21 machines)

Top financed brands: Cat (37 machines, 26 percent of total); Kubota (25/17 percent); Deere (19/13 percent); Bobcat (18/13 percent)

New Jersey

Total number of machines financed in the first quarter: 396 (Down 14 percent from 1Q 2018)

Top models: Kubota SVL95-2s CTL (16 machines); Kubota SVL75-2 (13 machines); Kubota KX040-4 compact excavator (9 machines)

Top three machine types: CTL (91 machines); compact excavator (89 machines); excavator (54 machines)

Top financed brands: Cat (97 machines, 25 percent of total); Kubota (67/17 percent); Bobcat (60/15 percent); Deere (59/15 percent)

New York

Total number of machines financed in the first quarter: 746 (Down 2 percent from 1Q 2018)

Top models: Komatsu WA270-8 wheel loader (27 machines); Cat 289D CTL (20 machines); Bobcat T770 CTL (18 machines)

Top three machine types: Compact excavator (203 machines); CTL (169 machines); skid steer (115 machines)

Top financed brands: Cat (174 machines, 23 percent of total); Bobcat (130/17 percent); Kubota (113/15 percent)

Pennsylvania

Total number of machines financed in the first quarter: 830 (Flat compared to 1Q 2018)

Top models: Kubota SVL75-2 CTL (42 machines); Kubota SVL95-2s CTL (26 machines); Cat 259D CTL (21 machines)

Top three machine types: CTL (249 machines); compact excavator (195 machines); excavator (106 machines)

Top financed brands: Cat (174 machines, 21 percent of total); Kubota (161/19 percent); Bobcat (119/15 percent); Deere (119/8 percent)

Rhode Island

Total number of machines financed in the first quarter: 49 (Down 40 percent from 2018)

Top models: Bobcat T870 CTL (4 machines); Bobcat S540 skid steer (3 machines); Bobcat T770 CTL (2 machines)

Top three machine types: Compact excavator (15 machines); CTL (12 machines); skid steer (8 machines)

Top financed brands: Bobcat (17 machines, 35 percent of total); Cat (12/25 percent); Kubota (2/12 percent)

Vermont

Total number of machines financed in the first quarter: 55 (Down 10 percent from 2018)

Top models: Kubota KX040-4 compact excavator (5 machines); Cat 289D CTL (4 machines); Cat 305E2 CR (3 machines)

Top three machine types: Compact excavators (17 machines); CTL (11 machines); skid steer (9 machines)

Top financed brands: Cat (22 machines, 40 percent of total); Kubota (9/16 percent); Bobcat (6/11 percent); Case (5/9 percent); Volvo (4/7 percent)

About the source

EDA, a division of Equipment World’s parent firm Randall-Reilly, tracks UCC-1 filings used by lenders when a machine is financed.

Depending on the type of machine, financed machines can represent 40 to 75 percent of the total number of machines of that type sold in the United States. While machines can also be bought by cash or letter of credit, which are not tracked by EDA, buyers of higher priced equipment (for example, a large excavator) tend to use financing. EDA continually updates its data.