Editor’s Note: This is Part One of an eight-part series on the evolution of construction equipment and the diesel fuel alternatives manufacturers are introducing, including hybrid machines, electric and battery-powered equipment, and hydrogen combustion and hydrogen fuel cell technology.

Diesel will continue to play a part in heavy equipment operations for years to come, but plans are in motion to reduce its prevalence in favor of a variety of new fuels and technology that produce lower levels of carbon-dioxide emissions.

Governments around the world are calling for “net-zero” legislation that will substantially accelerate this trend. In some estimates, half if not more of the energy that propels your machines will be obtained with alternative fuels and electrified equipment by the middle of this century.

“We hope that by 2040 we'll be done producing most diesel machines, or at least well on the way,” says Ray Gallant, Volvo’s vice president of product management and productivity for the Americas. “We are interested in any source that can provide the necessary energy we need in a sustainable process.”

So many options

The challenge contractors and OEMs face is that there is no single type of fuel or propulsion technology that will replace diesel. “Each application has its own unique requirements, so there isn’t a one-size-fits-all solution when it comes to powertrain,” says Preston Moore, solution planner and product manager for electrified drivetrain and propulsion batteries at John Deere Power Systems.

“Some manufacturers emphasize electrification while others are pursuing alternative fuels and hybrid solutions,” Moore says. “In today's equipment industry, it's important to aggressively pursue these sustainable technologies while optimizing power sources, like diesel and natural gas, that have helped our world run for centuries.”

The major contenders in this universe of alternative power sources include:

- Battery electric

- Diesel-electric hybrid

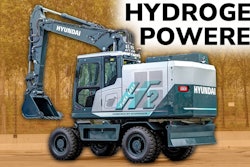

- Hydrogen and hydrogen fuel cells

Battery-electric and diesel-electric hybrids are already showing up in the field. Hydrogen power is on the cusp, and you can expect to see plenty of all three at ConExpo-Con/Agg in March 2023.

“We are advocating for all of them,” says Jacob Whitson, lead project manager at Calstart, a nonprofit that partners with industry and business to find low-carbon solutions to transportation and industrial enterprises. “There are no winners or losers,” he says. The best use cases will vary depending on the industry segment and business needs.

Calstart has projected a rapid rise in the number of electric mini-excavators as seen in the graph below. The organization is also offering a free whitepaper that assesses the technological and market readiness of zero-emission off-road equipment, and is available here.

Calstart, a non-profit that partners with industry and business to find low-carbon solutions to transportation and industrial enterprises, sees the evolution of net zero technology as starting with the easiest applications and gradually evolving to where heavy equipment and trucks can be powered by low- or no-carbon sources.CALSTART

Calstart, a non-profit that partners with industry and business to find low-carbon solutions to transportation and industrial enterprises, sees the evolution of net zero technology as starting with the easiest applications and gradually evolving to where heavy equipment and trucks can be powered by low- or no-carbon sources.CALSTART

- Part 1: A look at the battery-electric options, the sexiest and most talked about technology, thanks to its progress in the automotive industry.

- Part 2: A snapshot of some of the alternative-powered equipment options already on the market.

- Part 3: Diesel-electric hybrids. Most of this technology has been around for more than a decade and will serve as an intermediate step in the journey to a net-zero future.

- Part 4: A deep dive into hydrogen combustion and hydrogen fuel cell technology. Many are saying hydrogen will become the clear winner in the decades ahead — a true net-zero technology.

- Part 5: How rental companies are helping to drive innovation and market acceptance.

- Part 6: Perspectives from customers who have already adopted electric equipment.

- Part 7: Regulatory outlook. Will net-zero become the new Tier 5?

- Part 8: An electric equipment market forecast for the next five years.

Make no mistake, net zero is coming. This series will help you learn more about what’s in store for you and your business.

PART 1:

Battery electric: Popular with the OEMs, doable now, more to come

Like Tesla cars, battery-electric machines run on pure electric power supplied by a battery. Numerous OEMs already have battery-electric machines for sale and working in the field, most of them are compact machines.

According to Bloomberg, the electric construction equipment market is on pace to reach $24.8 billion by 2027, up from $9.2 billion this year.

Ray Gallant, Volvo vice president of product management and productivity for the Americas.Volvo Construction Equipment

Ray Gallant, Volvo vice president of product management and productivity for the Americas.Volvo Construction Equipment

Zero exhaust emissions

The obvious benefit of battery-electric is zero emissions at the exhaust stack. But depending on how they are recharged, they may not be truly net zero. If the electrons come from a coal or natural gas power plant, CO2 emissions are attached.

Nonetheless, Environmental Protection Agency studies have shown that battery-electric cars, even when charged by electricity from conventional power plants, produce about half the emissions of a conventional internal combustion car engine. Presumably, a similar power-to-CO2 ratio will occur with battery-electric construction machines charged on a conventional electrical grid.

Charging options

The availability of charging stations has been a concern in the automotive world. But there is a nationwide push to “electrify the corridor,” along interstate routes, says Calstart's Whitson.

President Biden’s infrastructure bill allocates $5 billion to develop more of these, and the U.S. Department of Transportation plans for the development of up to a half-million public charging stations along interstates by 2030. Presumably, contractors could recharge their equipment and their trucks here in a pinch. But most battery-electric construction equipment will be charged on the jobsite or back at the shop or yard because of the time it takes to recharge these systems.

Bigger machines (hence bigger batteries) will need more electrons for recharging than their smaller counterparts. The current offerings from OEMs range all the way from the slow-charging 120-volt/AC chargers up to 480-volt/DC three-phase power. DC current gets you the fastest charge, as little as two hours on some systems.

For contractors who want to charge on jobsites, setting up their own temporary electric power station will be necessary, but many equipment OEMs are developing portable charging solutions for customers. For landscapers and others who trailer their machines home every day, charging can happen overnight anywhere they can plug into 120- or 240-volt power.

Operational benefits

In addition to the environmental gains, battery-electric construction machines are proving to have operational benefits as well, says Gallant. In particular, he mentions less noise and vibration.

“The great thing about our electric machines is that owners get these benefits without a drop in performance compared to their diesel counterparts,” says Gallant. “That's seen in the machine specs, but more importantly, early equipment users have reported that that's been their experience on jobsites.”

For light and compact construction equipment – skid steers, compact track loaders, small wheel loaders and excavators – battery electric is looking like an excellent option, says Whitson. These machines fall roughly in the 50- to 100-horsepower (25 to 70 kilowatt) range. “That’s the perfect area to use battery-electric technology,” he says.

Performance plus

“We're learning daily with our electric compact machines, about applications and the opportunities to use the new technologies,” says Gallant. “One example is how low noise/vibration and lack of fumes fit into jobs. We've been surprised how high of a value customers place on reduced noise, emissions and operator comfort – all of which electric machines help.”

“Battery power offers increased controllability and reduced operating training time, making it easier and quicker to train operators, which has a positive impact on a business’ bottom line,” says Preston Moore, solution planner and product manager for electrified drivetrain and propulsion batteries at John Deere Power Systems.

Preston Moore, solution planner and product manager for electrified drivetrain and propulsion batteries at John Deere Power Systems.John Deere Power Systems

Preston Moore, solution planner and product manager for electrified drivetrain and propulsion batteries at John Deere Power Systems.John Deere Power Systems

OEMs are also starting to electrify the peripherals, like hydraulics, cooling fans and PTOs, with battery-electric vehicles, not just the tracks or wheels. Combined with sophisticated software management, electrification of the whole machine is expected to add another boost to performance, machine intelligence and automation.

How much?

Initial purchase costs are a concern. Projected prices for battery-electric construction equipment, by some accounts, could be triple that of their diesel counterparts.

But as Moore points out, battery prices are expected to decline, and future emissions regulations are likely to push the cost of an internal combustion engine (ICE) vehicle to a point where it could be more cost-effective to have a battery-electric vehicle.

Total cost of ownership

What will help defray the cost of battery-electric machines is their lower maintenance and operating costs. In an analysis done in 2013, Equipment World found that the operating and maintenance costs (fuel, PM, wear parts and repairs minus labor) of owning a diesel-powered skid steer were roughly double that of the initial purchase price.

For battery-electric machines, most of these costs fall to near zero. These machines have no oil changes, no engine or transmission rebuilds and vastly fewer moving parts, hence substantially lower lifecycle costs. Another cost-saving factor is idle time. With an ICE engine, construction equipment often idles 25 to 50 percent or more of its working life. With a battery-electric, there is no idle time. They use zero power (except perhaps the cooling fan and lights) until a load is applied.

According to the Association of Equipment Manufacturers, JCB did a lifecycle cost analysis on its battery-electric machines and found a 50 percent return on investment within three to five years.

Refinements needed

Still, there is work to be done. Off-road use will require special battery design and consideration around performance, durability and thermal management, says Moore. Frequent peak power output will require higher cooling capability and more robust cell chemistry, and harsh working conditions such as dust, dirt, fluid exposures and vibrations will require higher standards for electrical connectors and battery housings, he says.

The total lifecycle of the batteries is also an open question as is their replacement costs. But many OEMs are looking into battery recycling to help reduce these costs and lighten the equipment’s environmental footprint.

“As battery-electric vehicle costs reach parity with ICE vehicles and charging infrastructure is built out to support customer adoption, we believe customers will increasingly adopt battery-powered machines,” Moore says. “It’s important to note, however, that while battery power is proving itself to be a viable alternative solution for off-highway vehicles, it will take a variety of power sources to meet the unique needs of off-highway equipment applications.”